Welcome to an exclusive opportunity to secure prime real estate in Leon County! As part of our commitment to community development, we're excited to announce our surplus land sale. Discover the potential of these unique properties and make your dream investment a reality. Explore Surplus Land Opportunities: Our surplus land sale offers a diverse selection of properties, ranging from Continue Reading

Leon County Listed Properties designed: Certified Affordable Housing Land

Land listed with Hamilton Realty Advisors that is designed Certified Affordable Housing parcel; upon the sale of Certified Affordable Housing parcels, the net funds are provided to the Housing Finance Authority (HFA), for affordable housing. Continue Reading

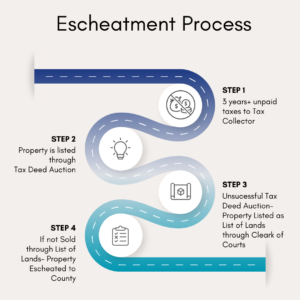

Buying Land in Leon County: What is an Escheatment Deed

Purchasing Land through Escheatment: A Unique Opportunity Escheatment stands as a distinctive avenue through which individuals can acquire property, facilitated by the county's acquisition of parcels due to unpaid property taxes over an extended period—typically three years or more. Governed by the guidelines outlined in 197.502 of the Florida Statutes, the Tax Collector initiates this process, Continue Reading

Thinking of Selling: What is a Listing Agent?

If you're thinking of selling your home, finding a listing agent is at the top of to-do list. But just what is a listing agent? How listing agents help you price your home How much is your home worth? That's a hard question to answer. You can get an estimated value by entering your address on realtor.com®, but from there you'll want to do some fine-tuning—and that's where a good Continue Reading

Tips When Searching for a Rental Property in Florida

With the high demand for a rental property, condo, and apartment we are seeing an increase in scam listings in the market place. Here are a few quick tips when searching for rental properties online, through Craigslist, or apartment apps. Tour the property in person: If the landlord or representing agent does not want to meet in person this may be a red flag. Google the address to see if it Continue Reading

Real Estate Investing: 1031 Exchange

Tiffany's Tip on Real Estate Investing: Investing through the 1031 Exchange When you purchase real property and it is sold- you incur a financial gain. This gain or profit is taxable during the calendar year of the sale. To defer the taxes due on this gain, the IRS offers a break under IRS Code-seection 1031. IRS Section 1031 provides an exception and allows you to postpone paying Continue Reading

Tiffany’s Tip: 1031 Exchange Simple Rules to Follow

1031 exchange rules to follow If you decide to do a 1031 exchange, once the money from the sale of your first property comes through, it will be with an escrow agent—an independent account monitored by a third party. The money will be available once a new property is identified. After the sale of the property you want to use for the 1031 Exchange, the clock starts once you have Continue Reading

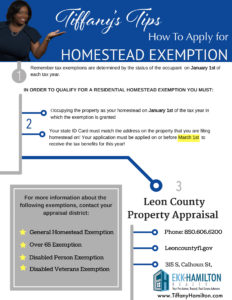

Tiffany’s Tips: Homestead Exemption Deadline

Did you just buy a new home? Will you be occupying your new residence? If your answer is YES to the questions above here are few tips to help you file your Homestead Exemption on time. For more information visit Leon County Property Appraisers www.LeonPa.org or Click Here Contact a Hamilton Realty Advisor today with any additional questions! Continue Reading