Purchasing Land through Escheatment: A Unique Opportunity

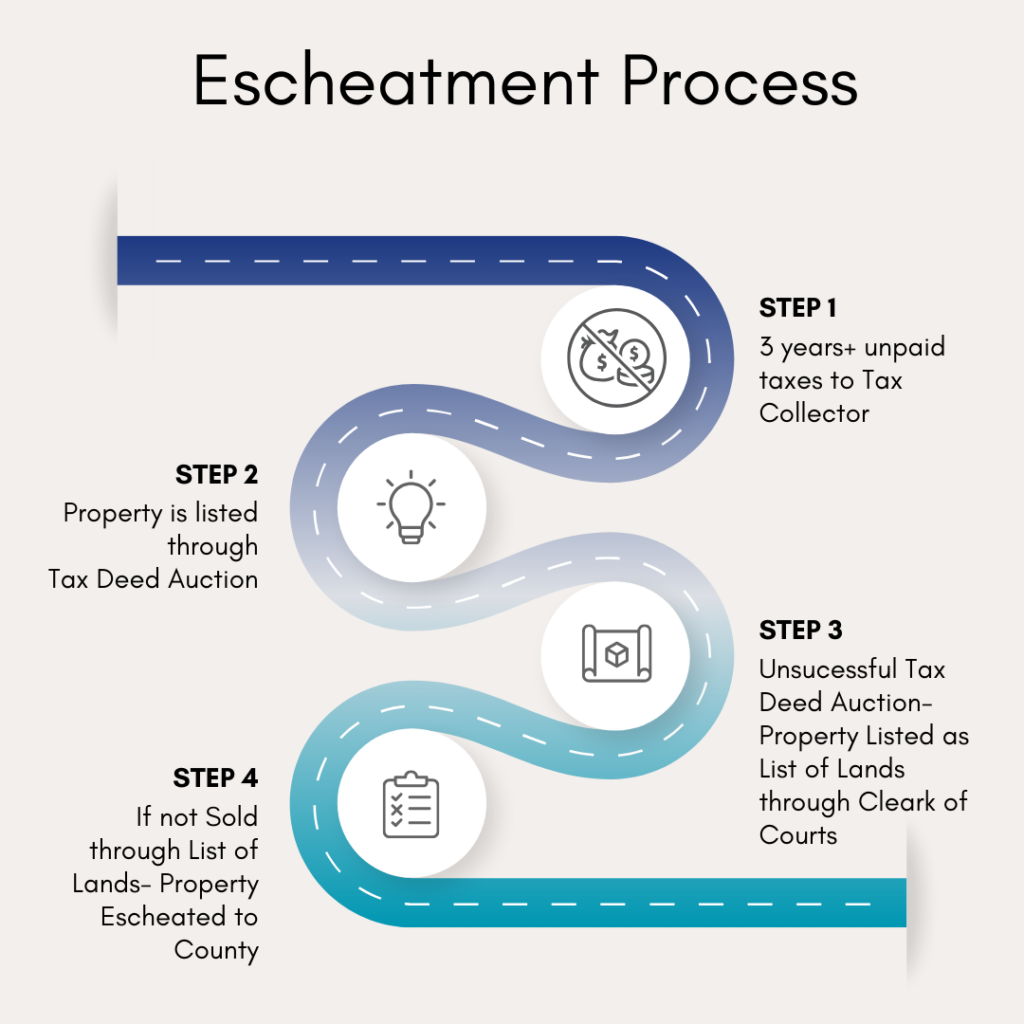

Escheatment stands as a distinctive avenue through which individuals can acquire property, facilitated by the county’s acquisition of parcels due to unpaid property taxes over an extended period—typically three years or more. Governed by the guidelines outlined in 197.502 of the Florida Statutes, the Tax Collector initiates this process, ultimately transferring the property to the county.

Following escheatment, not all properties undergo listing and sale. However, those that do offer prospective buyers a chance to secure diverse parcels with various potentials.

It’s worth noting that the original property owner retains the right to contest the tax deed process within four years through the Leon County Clerk of Court to redeem their property.

The Tax Collector follows the process established in 197.502, Florida Statutes, and subsequently conveys the parcel to the County.

After the property escheats to the county, not all properties will be listed and sold.

Note: THE ORIGINAL PROPERTY OWNER HAS FOUR YEARS TO CONTEST THE TAX DEED PROCESS VIA THE LEON COUNTY CLERK OF COURT TO REDEEM THEIR PROPERTY.

Properties acquired by Leon County through Escheatment and subsequently listed with Hamilton Realty Advisors are designated surplus and certified affordable housing.

Leave a Reply